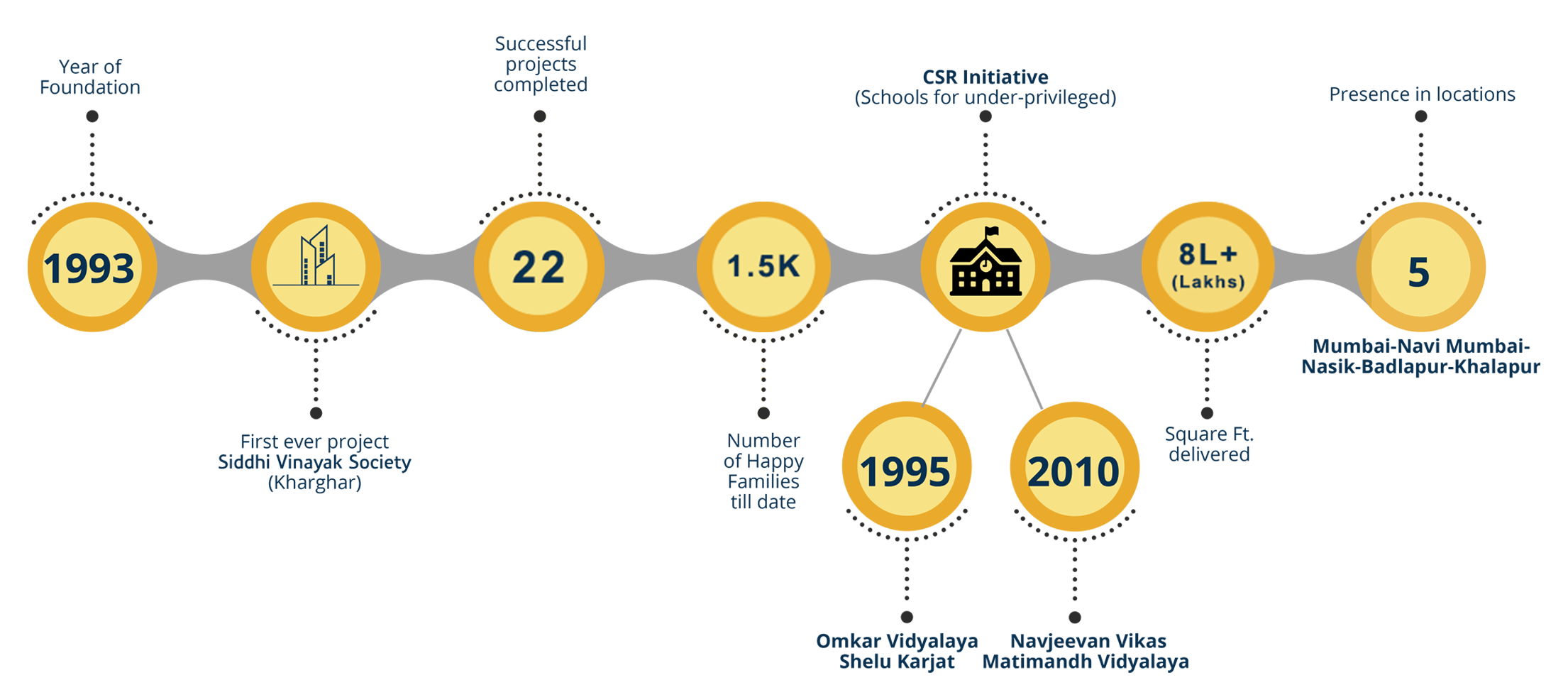

Landmarks

Year of Foundation

First ever project Siddhi Vinayak Society (Kharghar)

Started in 1993 & Delivered in 1995

Presence in Locations

(Mumbai-Navi Mumbai-Nasik-Badlapur-Khalapur)

Happy Families till date

Successful projects completed

Sq. Ft. delivered till date & counting

Omkar Vidyalaya Shelu Karjat

(CSR Initiative for under privileged)

Navjeevan Vikas Matimandh Vidyalaya

(CSR Initiative for under privileged)

Land parcels available on long lease for warehousing & logistics in Khalapur, Nashik & Bhiwandi

To Know more Please connect - 9619739099

NRI Corner

Buyers Guide

Buying a home requires a great deal of deliberation. Especially, first home buyers are faced with a lot of questions and confusion. Therefore, before making an investment in new residential property, it is recommended to be informed about all the necessary details right from basic paperwork to the reputation of the project. Once you have covered all the bases, you are rest assured that there are no surprises later. At Om Builders, we want you to make the right investment decision that promises you a great lifestyle living at affordable prices and projects featuring facilities designed for all age groups.

If you're first-time real estate investor looking to buy your dream home, having doubts about home loan, taxes or any other miscellaneous queries, we make sure you get complete assistance and answer all the questions so that you invest worry-free.

When you're buying a home, it is about putting all your savings into an investment for a lifetime. Along with the various costs involved in the entire buying process, you may also get tax benefit on the principal and interest component of the EMI. Up to Rs. 1 lakh is the amount of tax benefit a home buyer can claim on home loan interest payment. Under section 24, tax deduction is applicabe on interest paid for home loan applied for construction, purchase or repair of property. The maximum tax deduction allowed under Section 24 of a self-occupied property is subject to a maximum limit of Rs. 2 Lakhs.

Income tax exemption on repayment of home loan principal amount up to Rs. 150,000 (Rs. 2,00,000 for senior citizens) annually under Section 80 C of the Income Tax Act: